Capital Investment

- Levels: AS, A Level, IB

- Exam boards: AQA, Edexcel, OCR, IB, WJEC

Investment is spending on capital goods such as new factories & other buildings machinery & vehicles

- Much investment include and takes advantages of advances in technology

- Investment is a component of AD, and is a factor affecting competitiveness in a globalising world

- In market-based economies, most investment is done by private sector businessesbut a substantial amount comes from the government (in the state sector)

- A broader definition of investment includes spending on improving the human capital of the workforce through training and education to improve the skills and competences of workers

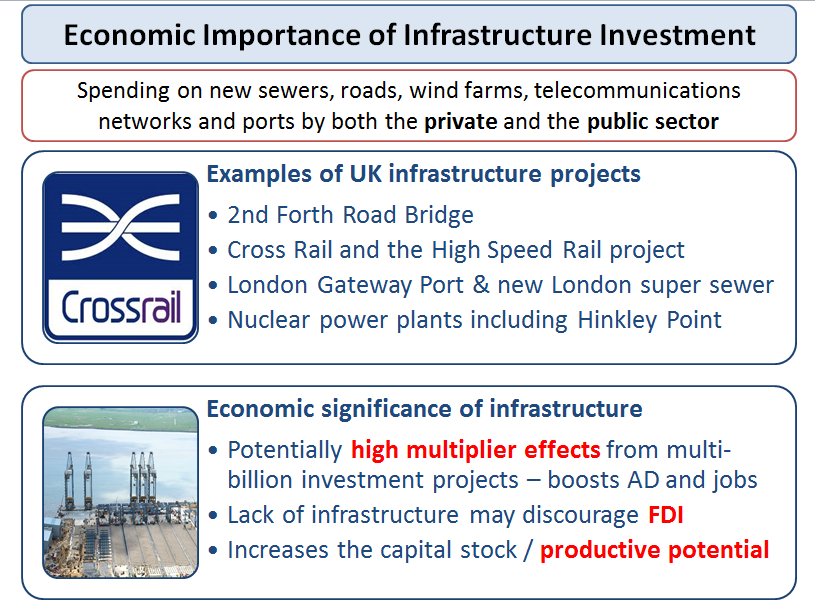

Infrastructure is spending on new sewers, roads, wind farms, telecommunications networks and ports – this is done by both the private and the public sector. Examples of infrastructure investment projects in the UK include:

- 2nd Forth Road Bridge

- Argyll wind farm array

- Cross Rail

- High Speed Rail project (flagship transport project – not yet started)

- Exeter flood defence scheme

- London Gateway Port

- Network Rail’s £28bn infrastructure plan for the UK rail network

- London’s new super sewer

- Nuclear power plants e.g. the proposed one at Hinkley Point

- £589m Mersey Gateway Bridge

- Heathrow Terminal 2 upgrade

- Gwynt y Môr offshore windfarm

Gross and Net Investment

Gross Investment pending is the total amount that the economy spends on new capital. But this figure includes an estimate for the value of capital depreciation since some investment is needed each year just to replace technologically obsolete or worn-out plant and machinery.

If gross investment is higher than depreciation, then net investment will be positive and this means that businesses will have a higher productive capacity and can meet rising demand in the future

Gross investment – capital depreciation = net investment

Investment and Aggregate Demand

- Investment is a component of AD i.e. (C+I+G+X-M). Businesses involved in developing, manufacturing, testing, distributing and marketing the capital goods themselves stand to benefit from increased orders for new plant and machinery.

A rise in capital spending will have a positive multiplier effect Increased spending on capital goods boosts demand for industries that manufacture the technology / hardware / construction sector

Investment and jobs

- Some investment projects cost people their jobs when a business replaces labour with capital inputs.

- Investment creates jobs in producing, designing and installing plant and equipment

Quality of investment

- A high level of investment on its own may not be sufficient to create an increase in LRAS since workers need training to work the new machinery and there will be time lags between new capital spending and the effects on output and productivity.

- If there is insufficient demand, a growing capital stock may lead to excess capacityputting downward pressure on prices and profits

Key factors affecting capital investment spending

What are the main factors that affect how much businesses can commit to investment projects?

1.Interest rates – which affect the cost of capital

- If the rate of interest increases, the cost of funding investment increases, lowering the expected rate of return on a capital project

- Higher interest rates also raise the opportunity cost of using profits to finance investment – i.e. a business might decide that they can earn a better return by simply investing the cash

2.Risk: Committing money to a project involves taking a risk for no business can be certain that a given project will succeed and bring about a profit. When risk and uncertainty is high for example during times of volatility then business investment spending may fall

3.The rate of growth of market demand: Investment tends to be stronger when consumer spending is rising. Higher expected sales also increase potential profits – in other words, the price mechanism should allocate extra funds and factor inputs towards capital goods into those markets where consumer demand is rising.

4.Corporate taxes

- Corporation tax is paid depending on the level of business profits. If the government reduces the rate of corporation tax there is a greater incentive to invest.

i.The main rate of corporation tax in the UK has been reduced from 28% in 2010 to 21% in 2015

ii.The Small Profits Corporation Tax Rate can be claimed by qualifying companies with profits at a rate not exceeding £300,000 per year. This tax rate has come down from 21% to 20%

- The government may also change the level of tax allowances e.g. the incentives for businesses to offset their investment spending against future tax bills

- Regulations can also affect planned investment. For example laws on carbon emissions might affect investment and innovation in the transport industry. The price of carbon emissions in the EU trading system might influence investment by businesses looking to cut their emissions and make significant progress towards low carbon production

5.Technological change and degree of market competition: In markets where technological change is rapid, companies may have to invest simply to remain competitive. A good example is the intense competition in the markets for smart-phones.

6.Business confidence: During a downturn many businesses may postpone investment because they feel that demand will not be high enough to give them the rate of profit they need. The Keynesian term for business confidence is animal spirits.

7.Social costs and benefits: In the public (government) sector, a different set of criteria may be used. Typically local and central government will use cost-benefit analysis when assessing the likely economic and social effects of investment; this is often used for infrastructure projects.

Research and Development Spending (R&D)

- In 2011 UK gross expenditure on R&D was £27.4 billion

- £17.4 billion (63.6%) of this was business investment

- £9.4 billion (34.6%) was government investment

- £0.5 billion (1.9%) was from private non-profit organisations

- UK R&D spending as a proportion of GDP was 1.79%, slightly below the EU average of 2.03%.

Revision video: The Accelerator Effect

Yang mau beramal Buat Sosial Yayasan Bank Syariah Indonesia (BSI) No. Rek : 1185300754

Comments

Post a Comment